Free Slots No Downloads No downloads are a great option to test your skills before you play betmarino güncel giriş

10 Best Ways to Invest in Real Estate or Landed Properties in Nigeria

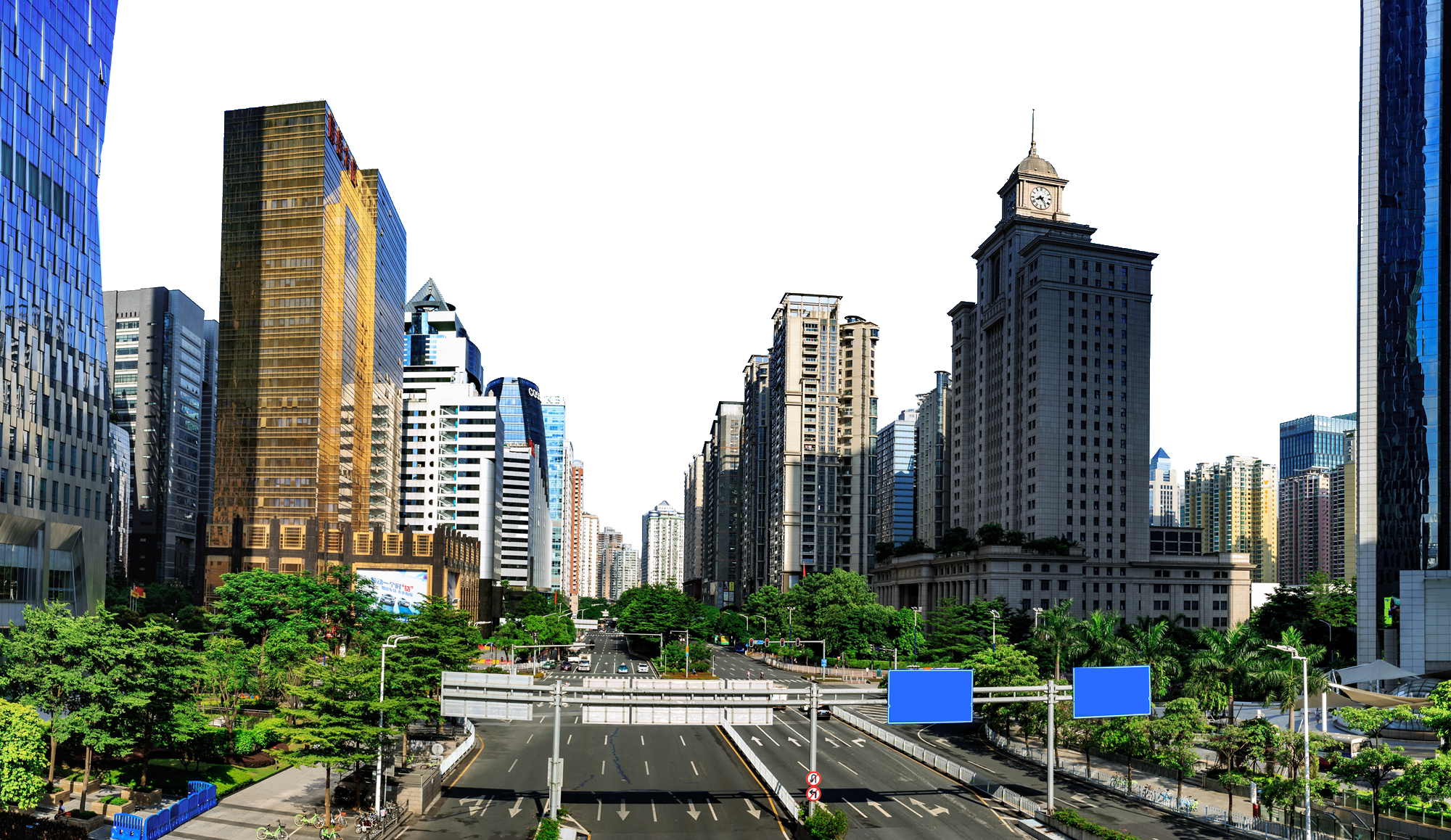

Investing in real estate or landed properties in Nigeria offers numerous opportunities for building wealth and securing financial stability. From urban developments to agricultural land, the options are vast and can be tailored to different investment goals. Whether you’re a seasoned investor or just starting, understanding the best strategies can make all the difference.

In this post, we’ll explore the ten best ways to invest in Nigerian real estate and help you decide which path is right for you.

1. Residential Real Estate:

Investing in residential properties is one of the most popular methods of real estate investment in Nigeria. With the increasing demand for housing in cities like Lagos, Abuja, and Port Harcourt, purchasing apartments, duplexes, or single-family homes can provide a steady income through rentals or substantial returns when you sell.

Benefits:

Consistent rental income.

Property appreciation over time.

Challenges:

Managing tenants and property maintenance.

2. Commercial Real Estate:

Commercial properties such as office spaces, retail centers, and warehouses can yield higher rental returns compared to residential properties. As Nigeria’s economy grows, so does the demand for commercial spaces, especially in urban areas.

Benefits:

Higher rental income potential.

Longer lease agreements.

Challenges:

Higher initial investment.

Vulnerability to economic fluctuations.

3. Land Investment:

Purchasing land is a long-term investment strategy that can pay off significantly, especially in developing areas. Land in emerging cities or urban expansion zones often appreciates rapidly as infrastructure and demand grow.

Benefits:

High potential for appreciation.

Minimal maintenance costs.

Challenges:

Land may remain undeveloped for years before it becomes profitable.

Risk of government acquisition or disputes over land titles.

4. Property Flipping:

Property flipping involves buying properties at low prices, renovating them, and selling them at a profit. This strategy requires market knowledge, renovation skills, and timing. Successful flipping can generate significant short-term profits.

Benefits:

Quick returns on investment.

Potential for high profits.

Challenges:

Renovation costs can exceed budget.

Market downturns can impact profitability.

5. Real Estate Investment Trusts (REITs)

REITs allow you to invest in real estate without directly owning properties. By purchasing shares in a REIT, you can benefit from the income generated by commercial properties like shopping malls, office buildings, and hotels, all managed by professionals.

Benefits:

Diversified real estate exposure.

Regular dividend income.

Challenges:

Subject to stock market fluctuations.

Management fees may affect returns.

6. Short-Term Rentals (e.g., Airbnb)

Short-term rentals, such as those offered through platforms like Airbnb, can be a lucrative option in popular tourist or business destinations. This approach allows property owners to charge higher rates for shorter stays, compared to long-term rentals.

Benefits:

Higher rental income during peak seasons.

Flexibility in property usage.

Challenges:

Requires active management and regular maintenance.

Income can fluctuate with seasons and market demand.

7. Agricultural Land Investment:

Investing in agricultural land is another viable option in Nigeria, a country with vast arable land. You can lease land to farmers or engage in agricultural production yourself. With the rising demand for food and agricultural products, this investment can yield good returns.

Benefits:

Steady income from leasing land or selling agricultural products.

Land value appreciation over time.

Challenges:

Subject to environmental risks (e.g., weather conditions, pests).

Requires specialized knowledge in farming and agriculture.

8. Joint Venture Partnerships:

In a joint venture, multiple parties pool their resources to invest in real estate projects. This collaborative approach can help investors tackle larger projects that may be beyond the reach of individual investors.

Benefits:

- Shared financial burden and risks.

- Access to larger projects and profits.

Challenges:

Potential conflicts between partners.

Complex decision-making processes.

9. Off-Plan Property Investments

Investing in off-plan properties means purchasing real estate before or during the construction phase. Developers often offer these properties at lower prices, making them an attractive option for investors looking to capitalize on future appreciation.

Benefits:

- Lower entry price compared to completed properties.

- Potential for significant value increase once construction is completed.

Challenges:

Project delays or cancellations.

Market conditions can change before completion.

10. Real Estate Crowdfunding:

Crowdfunding platforms allow multiple investors to pool their money to invest in real estate projects. This approach gives smaller investors access to larger projects with potentially higher returns.

Benefits:

- Lower capital requirement.

- Diversified investment across multiple properties.

Challenges:

Returns depend on the success of the specific project.

Limited control over the investment.

Conclusion

Investing in real estate or landed properties in Nigeria offers diverse opportunities to build wealth, whether you’re looking for immediate cash flow or long-term appreciation. The key is to choose the strategy that aligns with your financial goals, risk tolerance, and knowledge of the market.

At Gestpoint Nigeria Limited, we are dedicated to helping you navigate these opportunities with expert advice and innovative solutions tailored to your needs. Whether you’re interested in residential properties, commercial investments, or even agricultural land, we are here to guide you every step of the way.

Ready to make your move? Contact us today and start your journey towards financial success in Nigeria’s thriving real estate market!

Related Posts

Why Is Las Vegas the Best Internet Casino Site?

Yes, it’s perfectly legal to casino milyon güncel giriş bet on online gambling websites. However, if you are stalling because